Did voters have complete information when they voted for ST3?

Today I was invited to testify before the Senate Transportation Committee on Senate Bill 5893. Below are the comments I shared regarding the proposed legislation.

Of nearly 20 legislative bills prompted by Sound Transit’s car tab fee overcharges, there are only four that would adequately address and eliminate the unfair overcharges taxpayers are receiving in their mail. Senate Bill 5893 is one of those four bills.

Sound Transit 3 Mass Transit Guide

Sound Transit argues that voters approved car tab fees and that car tab information was available to the public when they voted for Sound Transit 3.

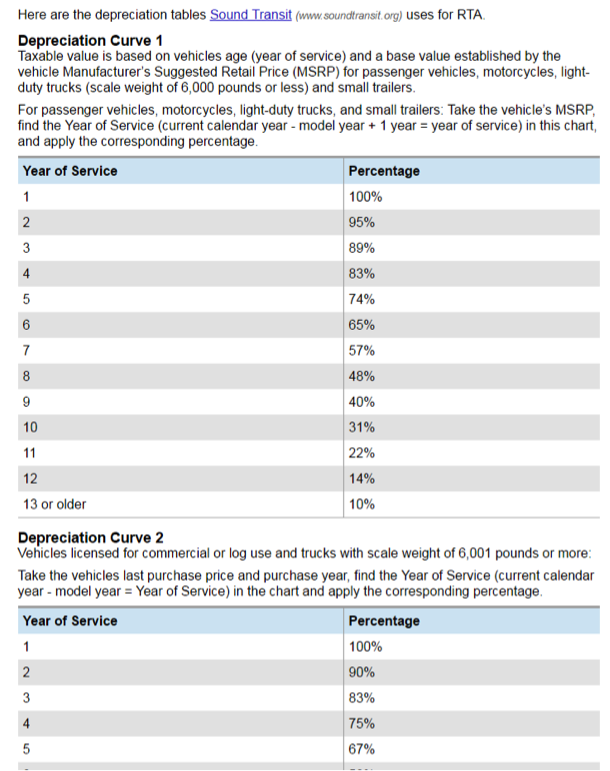

However, in the Mass Transit Guide that Sound Transit sent out to voters last October, they stated that the measure would include “A motor vehicle excise tax increase of 0.8 percent or $80 annually for each $10,000 of vehicle value.” This is misleading – as voters were not told that the $10,000 would be based on a repealed depreciation schedule that overvalues their cars and in effect, allows Sound Transit to collect maximum revenue from every car owner in the taxing district.

Department of Licensing

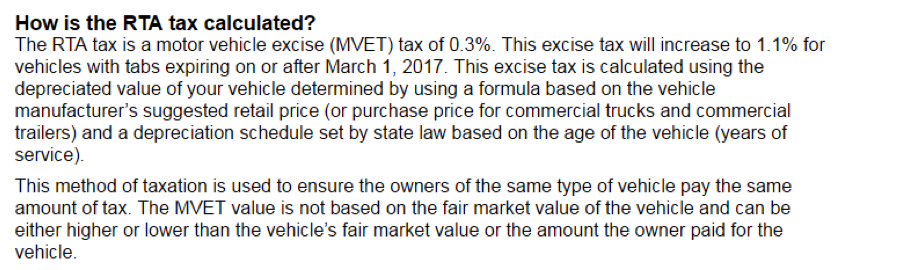

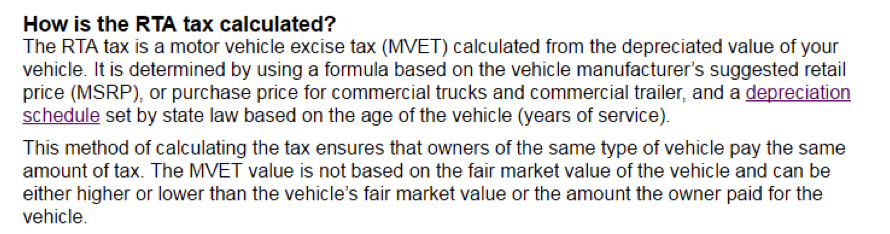

Whether this information was available to taxpayers through the Department of Licensing website is also arguable.

Links to the depreciation schedule in law were available on the Department of Licensing website going all the way back to 2006. The state agency, working with Sound Transit, even provided a link to an extensive transit excise tax schedule that shows exactly how much a driver would pay in each year of service based on the value range of their vehicles.

On December 11, 2013, those links were gone.

Why the DOL removed the links to the old depreciation schedule that Sound Transit likes to use for their car tab fees is unknown, but taxpayers have a right to view, understand and verify the taxes they pay.

After the reference to the depreciation schedule was removed in 2013, there was no mention of the depreciation schedule again until December 23, 2016 after the passage of Sound Transit 3. However, there was still no link or information provided as to which depreciation schedule was being used.

Only in 2017 does it appear that DOL updated their website with the exact depreciation curve – although even now, the webpage does not link the repealed RCW that Sound Transit still uses.

Although the Department of Licensing has always stated on their website that vehicles are not based on fair market value, the depreciation schedule was removed from their RTA tax page, and did not reappear again until 2017, after Sound Transit 3 was passed.

Sound Transit’s ST3 Calculator

Sound Transit officials and supporters also point to the ST3 calculator as proof that taxpayers knew what they were voting for. Sound Transit’s ST3 calculator requested that you input what your car tabs are worth today, and would multiply them by a factor to get what you would pay under ST3.

However, to understand the value of your vehicle and the methodology that Sound Transit chose to use, the voter would have to search outside of the calculator and outside of the voter’s pamphlet. This is not transparent. It would require the voter to take extra steps and call DOL or have some working knowledge of repealed and current RCWs.

Instead, voters simply trusted Sound Transit.

Senate Bill 5893 would fix this problem by ensuring that the public doesn’t have to trust Sound Transit or anyone else. They get to trust what they have trusted for decades – Kelley Blue Book or National Auto Dealers Association, which provide fair market, rather than artificially inflated, vehicle values.