Today is the first day of the 2016 Legislative Session. One of the issues facing lawmakers is how to respond to the people's approval of Initiative 1366 last November. Opponents of the measure have filed a lawsuit asking the courts to declare the proposal unconstitutional. That case will be heard January 19 in King County Superior Court. Last Friday the Attorney General filed arguments defending Initiative 1366. From the AG's brief:

A majority of Washington State voters approved Initiative 1366 in the last general election. Now, through this challenge, Plaintiffs seek to impose their own policy beliefs in an attempt to override the people’s legislative will. But Plaintiffs’ disagreement with the Initiative’s policy purposes does not convert what is otherwise a valid enactment of the people into one that is not . . .

I-1366 is a valid exercise of the people's legislative power that is in accordance with all of the constitutional requirements. The Initiative amends the state sales tax rate, an act that is plainly within the people's power, and merely makes it contingent on constitutional amendments that may or may not be taken up by the Legislature. I-1366 does not amend the state constitution nor alter the constitutional amendment requirements. Plaintiffs have not met their burden to prove I-1366 is unconstitutional beyond a reasonable doubt. Accordingly, the State of Washington respectfully requests that this Court deny Plaintiffs' motion for summary judgment and dismiss their challenge to I-1366.

The Attorney General's proposed order for the Court also questions the standing of some lawmakers being able to sue voters for approving Initiative 1366:

All of the plaintiffs lack individual standing because none of them suffer legal injury from I-1366’s passage.

The legislator plaintiffs do not have standing to bring this action because nothing in I-1366 restricts the legislators’ ability to propose or to vote for or against any constitutional amendment. Thus, the legislators are not harmed by I-1366. As a matter of law they have not alleged sufficient harm to amount to legislative standing under League of Education Voters v. State, 176 Wn.2d 808, 817-18, 295 P.3d 743 (2013).

With the possibility that the courts may invalidate Initiative 1366, the Washington Policy Center commissioned a poll conducted by Elway Research, INC asking about this scenario. 65% of voters across the state said that if the courts were to declare Initiative 1366 unconstitutional, they want lawmakers to send voters a constitutional amendment to end this debate.

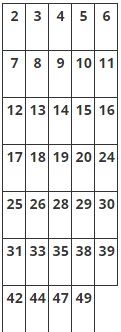

According to a breakdown by the Secretary of State's Office, voters in 69% of Washington's legislative districts (34 of 49) approved I-1366 (supermajority for taxes). This is significant since it takes support from lawmakers in at least 33 legislative districts to refer to voters a constitutional amendment. Assuming lawmakers reflect the preference of their constituents, there should be enough support to finally end the decades old debate about whether to require a supermajority vote to raise taxes with a constitutional amendment.

Legislative Districts That Supported Initiative 1366

Sen. Pam Roach has already filed two proposed constitutional amendments (SJR 8208 and SJR 8209) to provide voters the opportunity for the seventh time to consider this taxpayer protection policy but this time as part of the constitution.

There are currently more than 20 supermajority vote requirements in the state's constitution. Several of these provisions have been part of the Washington Constitution since statehood. The most recent supermajority restriction was added by lawmakers, and confirmed by voters, in 2007, with the requirement for a three-fifths legislative vote to spend funds from the budget-stabilization account.

The one component currently missing from the state constitution’s fiscal supermajority requirements is additional protection for state taxpayers on tax increases. Ultimately, the Legislature should allow the voters to harmonize the existing budget supermajority vote requirements with a tax restriction to complement the current higher threshold required for local tax-levy increases, incurring debt and spending one-time savings.