When releasing his 2015-17 budget plan Governor Inslee said, “We have a very solid, fiscally sound, secure and stable way of financing everything I’ve talked about today." Among the new taxes he proposes to fulfill this statement is a 7% capital gains tax to generate an estimated $798 million.

Based on the volatile history of capital gains taxes in other states, it may be wishful thinking to describe their impact as being a “very solid, fiscally sound, secure and stable way of financing” ongoing government spending. Consider the following comments about capital gains taxes:

- California’s Legislative Budget Office (LAO) says: "Probably the single most direct way to limit the state’s exposure to the kind of extreme revenue volatility experienced in the past decade would be to reduce its dependence on the source of income that produced the greatest portion of this revenue volatility—namely, capital gains and perhaps stock options."

- More from the LAO: “California’s tax revenues have numerous volatile elements, but among the more significant sources of revenue volatility are the state’s tax levies on net capital gains through the personal income tax. Every budget outlook must make assumptions about Californians’ capital gains realizations, either explicitly or implicitly.”

- Standard & Poor’s (S&P) said in a national report: “State tax revenue trends have also become more volatile as progressive tax states have come to rely more heavily on capital gains from top earners.”

- S&P also recently weighed in directly on Governor Inslee’s proposal: “In particular, the governor's proposal to impose an excise tax on capital gains could run into political opposition; therefore, it represents a source of risk to the budget since it accounts for over half of the revenue proposals. Although they would only weigh in on the matter indirectly through their elected legislators, voters in Washington have previously rejected initiatives to levy an income tax. This included a proposal to target the state's highest income earners, as the capital gains tax proposal would do . . . while the governor's proposal to tax certain capital gains income would likely offset some of the revenue slide (relative to personal income), it could cause the state's revenues to be more volatile. We have observed that capital gains-related tax revenues are among the most cyclical and difficult to forecast revenues in numerous other states.”

- The PEW Charitable Trusts recently said: “The problem for states trying to predict revenues is that stock market fluctuations and other cyclical events have a larger impact on incomes at the top, causing revenues from income taxes and capital gains taxes to vary widely from year to year . . . The report said the growth in forecasting errors is mostly attributable to tax revenue volatility, which is driven by increased reliance on capital gains income taxes, and on corporate income taxes, personal income taxes and sales taxes, besides volatility in corporate income taxes. Lesser errors are attributable to fluctuations in sales taxes . . . ‘One of the charges to the committee is to look at volatility,’ she said. ‘Certainly when there are capital gains there is roller coaster revenue coming in when people sell (stocks) and pay the capital gains tax. If you budget that way for the next year and it doesn’t happen, you have a deficit,’ she said.”

There was also this warning from the state Department of Revenue (DOR) the last time lawmakers considered a capital gains tax in Olympia (House Bill 2563 in 2012):

Capital gains are extremely volatile from year to year. Revenue from this proposal will depend entirely on fluctuations in the financial markets and can be expected to vary greatly from the amounts presented here.

Although a similar warning from DOR is not in the current fiscal note for House Bill 1484, they said the reason for this was:

When staff prepare the fiscal notes, they may or may not look at prior years’ notes as their starting point. In this case, staff said the volatility issue is understood and discussed by folks on the hill.

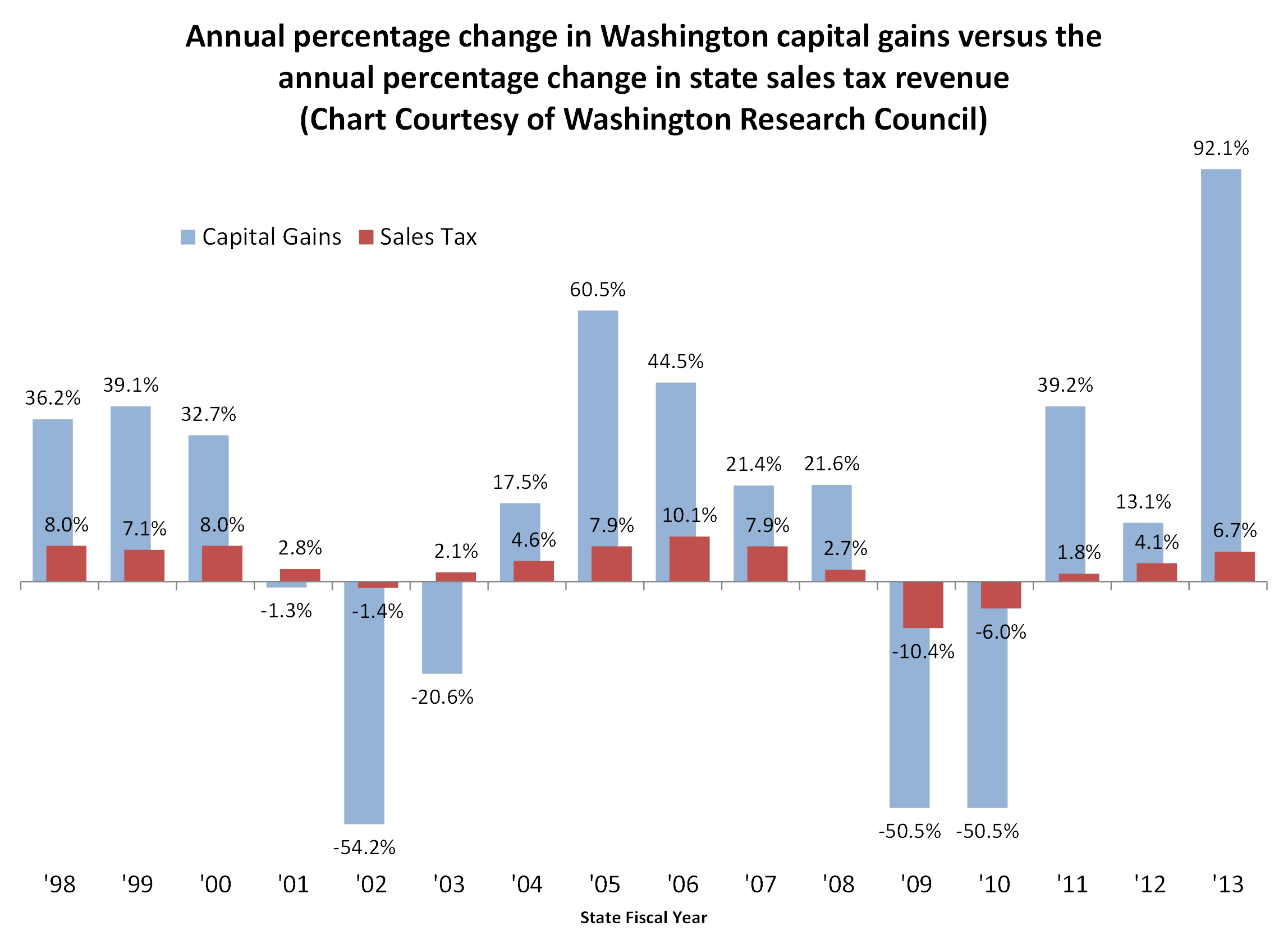

Also consider the recent history of capital gains revenue volatility in Washington. According to a study by the Washington Research Council:

In percentage terms, the swings in capital gains are much bigger than the swings in state sales tax revenue. Moreover, the two series are highly correlated: in each of the three instances where sales tax revenues were lower than in the preceding year, capital gains decreased by more than 50 percent.

As previously noted by the California Legislative Analyst Office, that state has been particularly hard hit by the volatility of its capital gains taxes. So much so in fact voters in California last November approved a constitutional amendment to require the state put a specific percentage of its capital gains tax revenue into protected savings so it couldn’t be spent and exacerbate budget shortfalls.

Explaining the impact of the constitutional amendment the LAO said:

This constitutional amendment separates state spending from the rollercoaster of revenue volatility. This measure takes capital gains revenues that make up more than 8% of the General Fund - the average for the last 10 years - off the table rather than being used for unsustainable permanent tax cuts or ongoing programs. The spiking revenues (along with 1.5% of overall General Fund revenues) will be used for debt payments and deposited into the BSA, to be withdrawn during economic downturns to avoid program cuts and middle class tax increases.

Rather than dedicate any of the revenue from his proposed capital gains tax to protected savings, however, Governor Inslee’s plan takes the opposite approach by preventing the funds from going into state’s constitutionally protected reserve account created by voters. Instead he directs all of the revenue to the Education Legacy Trust Account. We'll discuss this in more detail in our next post.