![]() Download a PDF of this Legislative memo with sources and citations here.

Download a PDF of this Legislative memo with sources and citations here.

Key findings

- The levy swap would reduce local funding for local teacher pay and programs.

- The levy swap would increase the state property tax to $3.50 per thousand in assessed value, close to the constitutional limit.

- The state supreme court says levy reform is not required by the constitution.

- Levy swap proposals would do nothing to increase education choices for families or encourage greater involvement by parents in their children’s education.

Introduction

State lawmakers are debating the merits of an education funding idea called the “levy swap.” The levy swap is a response to the state supreme court’s desire expressed in its ruling in the 2012 McCleary case that the state legislature devote more money to funding public education and to limit local levies.

Various proposals contain different details, but in general the idea is the legislature would increase the state property tax for public schools, take money people pay now in local school taxes and redistribute it statewide, while in turn reduce and limit the taxes people pay to local school districts.

Proponents say the levy swap will reduce inequity in how school districts are able to raise money to cover their expenses and pay staff. They say that equalizing local property tax levy rates is necessary to spread the tax burden for schools across the state.

In general, the levy swap would result in property-wealthy districts paying more and property-poor districts paying less. Specifically, the levy swap proposal would lower tax levy rates in districts with lower property tax bases, mostly in eastern Washington, and would either not affect or only slightly lower local tax levy rates in districts in western Washington, where the property tax bases are larger. Due to the increase in the state property tax, western Washington districts will likely see a net property tax increase from the levy swap.

According to one legislative proposal, the levy swap would represent a significant tax increase, increasing the financial burden of state government by an estimated $400 million by 2018 and $1.36 billion by 2019.

Tax effect on school districts

Press reports indicate a levy swap would mean a net property tax increase to 123 school districts with high property values, and a net property tax decrease to about 171 districts with low property values.

Families in Western Washington, especially in the high-value real-estate areas of Seattle and Bellevue, would see their property taxes rise significantly, even for those who are retired or living on a fixed income. In Seattle, the state property tax would increase in 2019 to $3.83/thousand of assessed value, from the current $2.40/thousand, with a $0.06/thousand decrease in local levy taxes.

The net property tax rate increase of $1.37/thousand in Seattle would add $767 in annual property taxes to the cost of an average home. In Bellevue, the state property tax would also increase in 2019 to $3.83/thousand assessed value, a net rate property tax increase of $1.43/thousand, increasing annual property taxes on the average home by $1,315 a year. The same calculation for Mercer Island would increase property taxes on the average home by $1,612 a year, and in the Lake Washington School District an increase of $690 a year.

Families in Eastern Washington would likely see their property taxes decline, at least initially, until a future legislature possibly decided to weaken local levy limits in the levy swap.

Districts in Eastern Washington and districts with low property tax bases already benefit from a program designed to spread the tax burden for schools across the state. This program is the Levy Equalization Program, which provides $742 million in the current budget.

Levy swap background

One goal of the levy swap idea is to respond to the state supreme court’s desire expressed in its ruling in the 2012 McCleary case that the legislature devote more money to funding public education.

Lawmakers have done just that. Since the ruling, the legislature has increased school funding from $13.4 billion in 2011 to $18.2 billion in 2015, a $4.8 billion, or 36 percent, increase. When local levies and federal funds are added to state funds, Washington’s schools on average will spend $12,500 per student by 2017, an increase of $2,500 per student since 2011. Currently Washington public schools receive about twice as much money per student as the tuition charged at many private schools.

Much of the policy reasoning behind the proposed levy swap is to further increase teacher pay. In their August 2015 order, the McCleary judges also called for increasing teacher pay.

In 2014-15, average teacher pay is $62,377 for a 10-month work year, of which $52,485 is funded by the state, with the rest funded from local levy property taxes. In 2015-16 teacher salaries are scheduled for another significant increase. In Seattle, the state’s largest school district, combined state and local funding for teacher pay will be as high as $91,300 for a 10-month work year. In most communities public school teachers receive salaries and generous health and retirement benefits well above the average income and benefits earned by most working families.

The levy swap represents a state tax increase, and caps on local levy will likely increase

Lawmakers say the levy swap would be “revenue neutral” and that overall people would not pay more in tax. This claim is difficult to assess. The levy swap would certainly represent a large increase in the state property tax, but it may not be fully offset by reductions in local levies. The state may even divert this money to non-school purposes, as it has done in the past.

A further concern is that the limitation on local tax increases may be temporary. The legislature has capped local levy increases before, starting in the 1970s, and then over time weakened or eliminated the cap. As a result, property owners would end up paying both, higher state taxes and higher local taxes. That outcome would represent an effective repeal of the “swap” part of the levy swap concept.

The only portion of the levy swap certain to enjoy a long life is the large increase to the state property tax, as lawmakers have shown no inclination to cut state-level taxes.

The levy swap would reduce local funding for local teacher pay and programs

In Washington state, local control of the schools has been used to create excellent school programs in some districts. In Bellevue, for example, local levy money is used to fund a seventh period in middle and high schools. Bellevue’s levies also make it possible for the schools to offer world languages for middle school, smaller class sizes, and additional supports for students.

In Seattle, local levies pay for teachers’ salaries, athletics, special education and unfunded state mandates. In Seattle, unions insist on local levy funds to boost teacher salaries, and by extension, local dues collections. In 2014-15 Seattle used local levies to add, on average, $17,000 to teacher salaries, significantly supplementing the average of $50,000 per teacher funded by the state. (Note: Salary figures are for a ten-month work year.)

Under the levy swap, a large increase in the state property tax would reduce the capacity of voters to continue supporting local levies. Loss of levy funds may force these and other school districts to cut some or all of these programs for students, and levy-funded increases in teacher pay.

The levy swap would increase the state property tax to $3.50 per thousand in assessed value, close to the constitutional limit

One of the levy swap proposals raises state property taxes to $3.50 per thousand of assessed value in 2019. The constitutional limit is $3.60 per thousand of assessed value. In Seattle and Bellevue, the state property tax will exceed the constitutional limit in 2019. This is not a responsible policy because it limits prospects for tomorrow’s children.

Working families are not appreciated for the contributions they make to teacher compensation in the public schools. Under the levy swap, families in many districts will see their property taxes increase significantly so the state legislature can tell the supreme court it has enhanced teacher pay.

The state supreme court says levy reform is not required by the constitution

Some supporters of the levy swap idea say the state supreme court ruled in the McCleary case that a levy swap bill must be passed. At first, the court did say the state’s over-reliance on local levies is unconstitutional. However, the justices have since retreated from this position. In their court order of August 13, 2015 the justices said they had decided levy reform is not required.

Washington has been struggling to comply with court-ordered school funding directives for close to 40 years, since the 1978 Doran decision. In the Doran ruling the court said public schools should not rely on local levies for basic funding. In response the legislature created the state property tax for schools, and limited local levies to 10 percent of total district revenues, so local taxpayers would not be required to pay twice to fund the same public program.

The flaws in the Doran ruling soon became apparent. Within a few years the legislature began lifting the 10 percent limit, under pressure from the Washington Education Association (WEA), the state teachers union. Since the 1970s the legislature has repeatedly raised the limit, so that today local levies can comprise up to 28 percent of revenues.

The legislature also created a bookkeeping device called Time, Responsibility and Incentive (TRI) pay. The TRI program further erodes local property tax protections by allowing unions to seek funding increases for teacher pay and benefits.

The levy swap idea fails to increase educational options and involvement for parents

In its McCleary ruling the state supreme court said fundamental school reforms are needed for Washington to meet its constitutional obligation to its students because pouring more money into an outmoded system will not succeed. The levy swap idea double-downs on the current public school model by simply re-arranging the way lawmakers fund the existing public education monopoly.

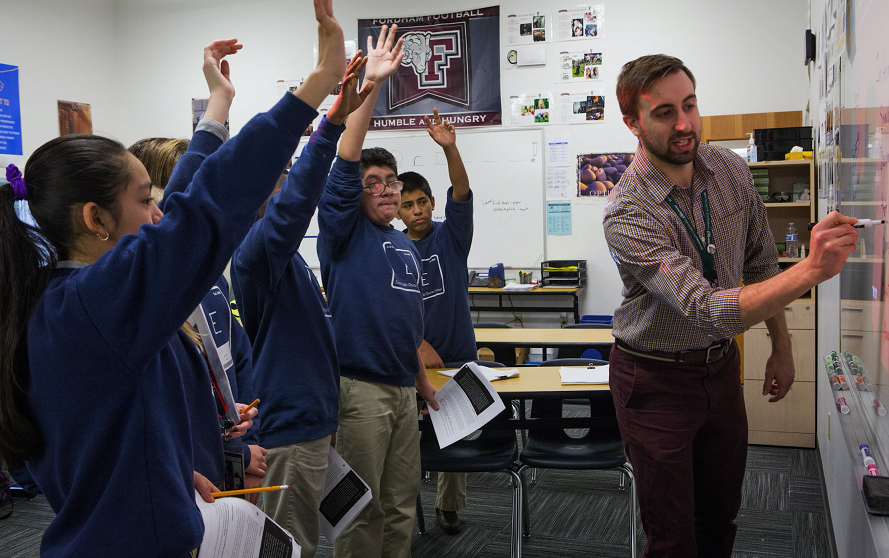

Levy swap proposals would do nothing to increase education choices for families or encourage greater involvement by parents in their children’s education. Charter schools, after- school tutoring services, online education and, in other states, fully-funded Education Savings Accounts, are policy initiatives which allow parents to make key decisions in accessing education services for their children.

The WEA union represents the primary obstacle to reforms and to forward-looking change. Levy swap proposals do not reduce the power of unions in the system, meaning any reform initiatives associated with a levy swap would almost certainly be blocked by lobbying, strikes and collective bargaining at the state and district level.

Conclusion

Bellevue’s schools are a good example of how local levies and local control help schools deliver excellence. Massachusetts, the state with some of the best schools in the country, relies heavily on local levies to fund its schools.

Lawmakers should not pass a levy swap plan, and should reassess the shifting and flawed funding mandates imposed by the state supreme court in the confusing McCleary decision.

Rather than debating the balance between local and state-level funding sources, lawmakers should seek ways to expand family choice in education.

In public education, changing funding sources is less important than improving how the money is used. Family choice programs, like charter schools, online education programs, after- school tutoring and fully-funded education saving accounts give families direct control over their children’s education dollars. This allows services to be tailored to student needs, and creates an incentive for school administrators to be responsive to the voices of parents.

A better model for funding public education would be to give parents a greater role in making key educational decisions, while giving local administrators flexibility in hiring and paying teachers, adjusting rules and programs to serve students better, and in delivering more resources to school classrooms.