Of nearly 20 legislative bills prompted by Sound Transit’s car tab fee overcharges, Sound Transit says they are only “seriously considering” House Bill 2148, which would create a rebate program of up to 40% on inflated car tab fees or property taxes paid by low-income individuals.

However, if Sound Transit officials really believed that their regressive taxes are unfair to low-income people, they would not have imposed them to begin with.

Although a rebate program for low-income people seems like a good thing, the proposed legislation fails to address the reality that people can’t afford to write these checks in the first place.

If this bill passes, Sound Transit officials would still expect families to pay up front with money they may need for food, gas and rent. Then, if they make time to file for a rebate, they might get up to 40% back later.

But families are asking for relief now, not maybe later. They should not have to choose between registering their car or paying for critical household needs.

This bill also fails to consider the cost to administer such rebates. In 2015, Seattle moved forward with a similar idea - $20 car tab rebates for low-income drivers, with $17 overhead costs – an 85% administrative cost. What would the cost be under House Bill 2148?

This proposed legislation appears to be helpful but does nothing to fix the regressive burden Sound Transit has imposed on everyone in their taxing district. In that sense, the bill is not a lifeline to low-income families. It is, instead, the ultimate insult because it primarily benefits elected officials and how they look before the public.

Additionally, if Sound Transit officials believe that that their inflated car tab fees are unfair to low-income families, then why not provide relief across the board to all working families? Why are families in other classes of income less deserving of fair taxation?

As I’ve said before, an across-the-board fix would require Sound Transit to pay off old bonds to detach ST3’s new car tab fees from the outdated, repealed valuation method. The agency can do this and lower your car tab fees tomorrow. Yet Sound Transit officials seem unwilling to do the right thing because it is not in their financial interest.

Instead, they say that defeasance is their “nightmare scenario” because it would cost them money.

Another proposal would require the Department of Licensing and the county auditor to send project update statements with vehicle renewals and property taxes. Like the rebate bill, this proposal sounds good on the surface. However, Sound Transit officials continue to report their projects are “early and under budget” even though they are more than a decade late, suggesting any “accountability” statistics provided would contain similar misleading updates.

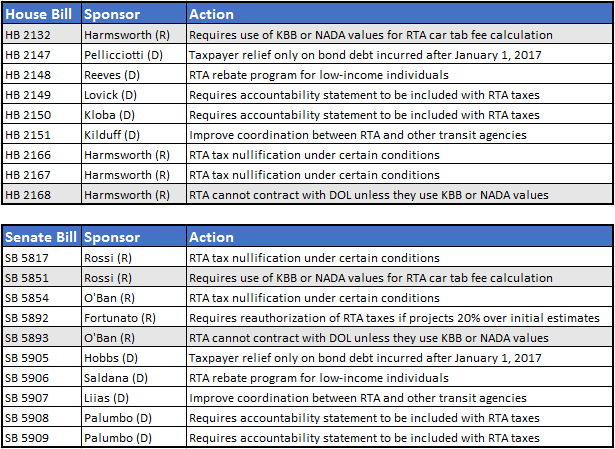

The only bills that would eliminate the unfair overcharges taxpayers are receiving in their mail are:

- Representative Harmsworth’s House Bill 2132 and Senator Rossi’s Senate Bill 5851, which would require Sound Transit to use Kelly Blue Book or National Auto Dealers Association values, whichever are lower, to calculate a motor vehicle excise tax;

- Representative Harmsworth’s House Bill 2168 and Senator O’Ban’s Senate Bill 5893, which would require Sound Transit to use Kelly Blue Book or National Auto Dealers Association values to calculate a motor vehicle excise tax, or the agency cannot contract with Department of Licensing to collect the car tab fees.

Senate Bill 5851 and Senate Bill 5893 will likely be heard in the Senate Transportation Committee next week.

House Bill 2132 and House Bill 2168 have not been scheduled to receive a public hearing, nor have they been included in the list of Sound Transit reforms promoted to media by House Democrats.

It seems that effective bills that would bring tax relief to families and accountability to the Sound Transit Board are being stalled by the House Transportation Committee. Meanwhile, feel-good bills that bring no immediate tax relief to families and have no impact on Sound Transit’s unfair taxing practices are being promoted as real reform.

The Sound Transit Board is not accountable to voters, but lawmakers are. It’s time to stop playing political games and do the right thing on behalf of constituents’ financial interests, rather than the financial interests of Sound Transit.