Tax or Fee: I-1631 Language Is Same As Gov's Carbon Tax

Supporters of a carbon tax turned in signatures this week to put Initiative 1631 on the ballot this fall for the voters. Except, they don’t want it called a “carbon tax.” They call it a “pollution fee.” They admit, however, there is no difference in the amount taxpayers will pay.

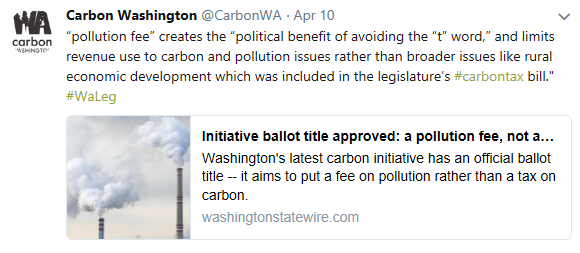

Supporters of I-1631, like Carbon Washington, note the change in language has a “political benefit” because voters may think they won’t pay the “fee.” As their own tweet admits, however, it has nothing to do with who pays, but how the money is spent. In fact, the language in the initiative and the Governor’s carbon tax is almost identical when it comes to the cost.

Supporters of I-1631, like Carbon Washington, note the change in language has a “political benefit” because voters may think they won’t pay the “fee.” As their own tweet admits, however, it has nothing to do with who pays, but how the money is spent. In fact, the language in the initiative and the Governor’s carbon tax is almost identical when it comes to the cost.

For example, the Governor’s carbon tax legislation rejected by the legislature earlier this year, said, “The tax rate is equal to twelve dollars per metric ton of carbon dioxide.” By way of comparison, the initiative says, “the pollution fee on large emitters is equal to fifteen dollars per metric ton of carbon content.” There are only two differences (aside from the starting price).

First is “carbon dioxide” versus “carbon content.” The initiative defines “carbon content” as “the carbon dioxide equivalent.” There is no difference.

The only other difference is the reference in the initiative to “large emitters.” What are “large emitters”?

When it comes to gasoline, the initiative says: “For motor vehicle fuel and special fuel, entities required to pay the tax specified in RCW 82.38.030(9).” By way of comparison, the Governor’s legislation applied the carbon tax for gasoline this way: “For motor vehicle fuel and special fuel, the carbon pollution tax is imposed on the seller or user of the fuel at the points of taxation specified in RCW 82.38.030(9).” They use virtually the same language and reference the identical definition in state law. There is no difference.

How about electricity? The initiative says, “(i) An importer of electricity that was generated using fossil fuels or is subject to a default emissions factor under section of this act; or (ii) A power plant located in the state of Washington that generates electricity using fossil fuels.” The Governor’s carbon tax said, “The generation within or import for consumption to this state of electricity generated through the combustion of fossil fuels.” Both apply the tax to electricity that was generated using fossil fuels either within Washington or imported. Again, the definitions are the same.

So, the tax and the “fee” are levied in the same way on the same people.

Supporters of I-1631 will argue the money is spent is differently, which makes it a “fee.” This is debatable, but it doesn’t impact who pays. During the campaign, environmental activists will imply the word “fee” means it is different than a tax when it comes to who pays. That is simply false, as the language of the initiative itself demonstrates.