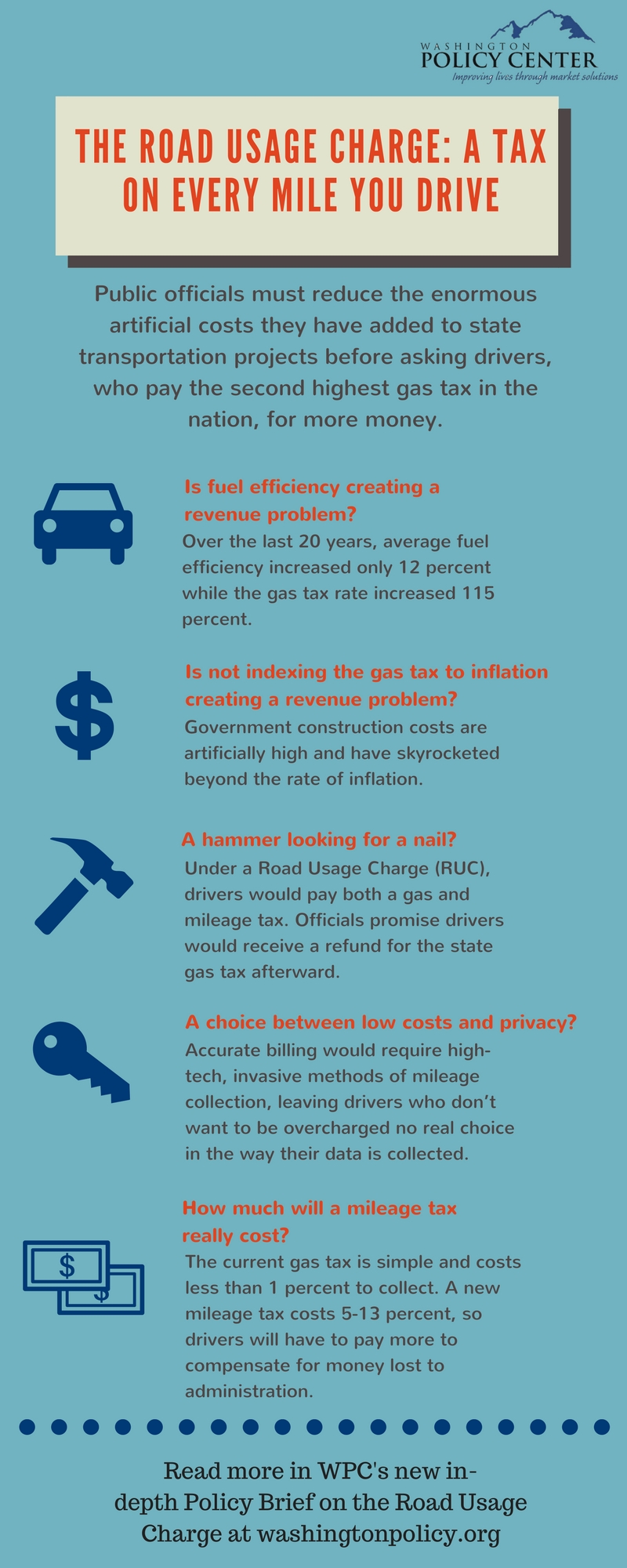

The Road Usage Charge - to impose a tax on every mile you drive

![]() Download the full Policy Note.

Download the full Policy Note.

Read the in-depth Policy Brief on this subject

Key Findings:

- Washington drivers pay a total gas tax of 67.8 cents a gallon, the second highest in the nation.

- Gas tax revenue is at record highs, and is expected to rise 11.3 percent to $3.65 billion in the next biennium. Over 10 years, officials say fuel tax revenues will amount to $18.3 billion.

- Although people are paying more than ever, state transportation officials want to impose a mileage tax on drivers to raise more money for general transportation programs that are not related to highways.

- Under a Road Usage Charge, drivers would pay both a gas and mileage tax, with a rebate for the state gas tax afterward.

- Enforcement of a mileage tax raises concerns about fairness and privacy, as government officials could track when, where, and how much people drive.

- Administration of a mileage tax is costly, and would likely require officials to collect a higher tax rate to make up for the money they spend on administration.

- Public officials should increase public trust by reducing the artificial costs they have added to transportation projects and stopping the practice of diverting money from drivers to non-highway purposes.

- Adopting regulatory reforms, rather than imposing a new tax, would free up public money for highway purposes and traffic congestion relief, where the traveling public demands it the most.

Introduction

Drivers pay most of the taxes and fees that fund the state’s transportation programs. Nationally and in Washington state, the highway system was constructed largely on the premise that users of roads should pay to build and maintain them.

Policymakers have used this user-fee principle to build thousands of miles of all-weather roadway, which allows Washingtonians to drive more than 60 billion miles per year, producing industrial growth, mobility, economic freedom, and a higher quality of life for everyone.

State officials have increased the gas tax over time. Today, Washington’s gas tax rate of 49.4 cents, coupled with the federal gas tax rate of 18.4 cents, is 67.8 cents per gallon, the second highest in the nation.

In fact, fuel tax revenue is expected to rise 11.3 percent to $3.65 billion in 2017-19, up from $3.28 billion for the current biennium. Over 10 years (2016 to 2025), officials project fuel tax revenues will amount to $18.3 billion.

Although people are paying more than ever, transportation officials say the gas tax is a declining source of revenue and is not enough to cover the rising costs of transportation construction and maintenance. State officials want to impose a mileage tax on drivers to raise money for transportation.

![]() Download the full Policy Note.

Download the full Policy Note.

Read the in-depth Policy Brief on this subject