Reducing the burden of the death tax on families

Lawmakers should repeal the state estate tax or increase the exemption to $3 million to bring relief to 46% of taxpayers, while still raising 94% of current revenue for the state.

Key Findings:

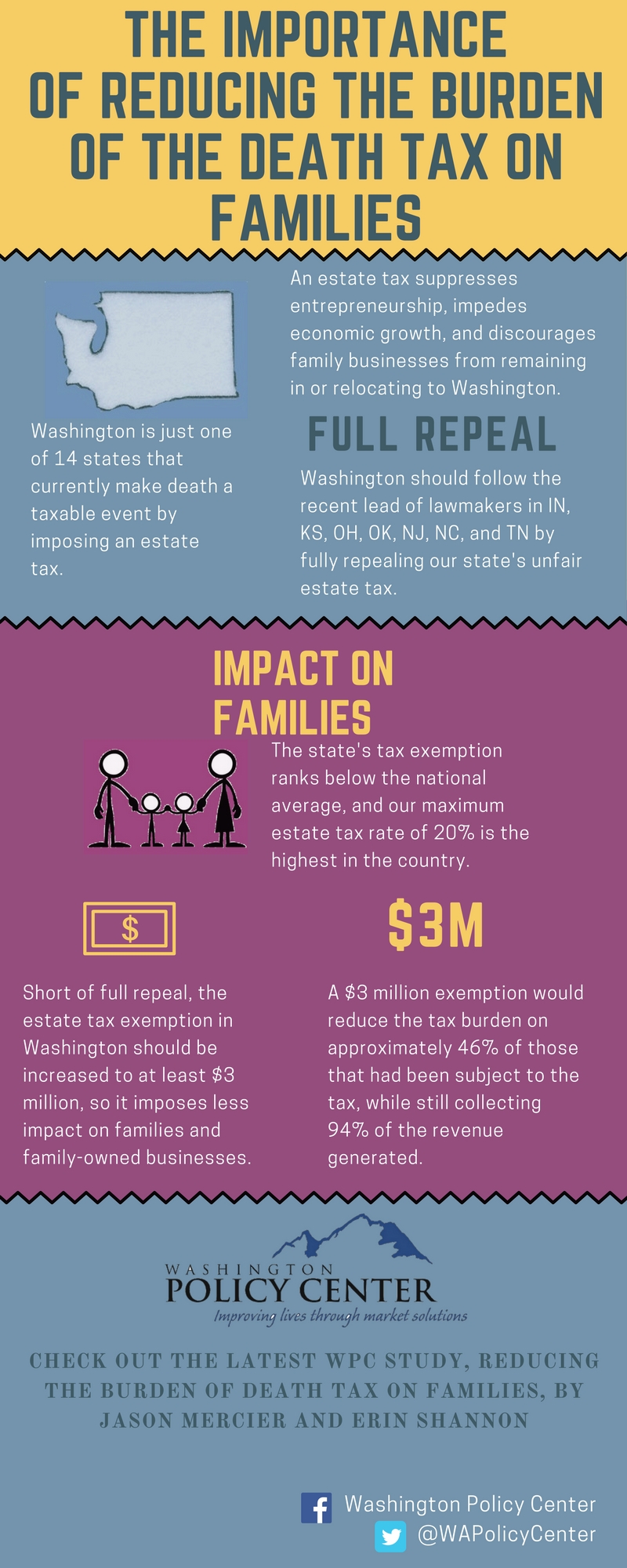

· An estate tax suppresses entrepreneurship, impedes economic growth, and discourages family businesses from remaining in or relocating to Washington.

· The state’s estate tax exemption ranks below the national average, and our maximum estate tax rate of 20% is the highest in the country.

· Washington should follow the recent lead of lawmakers in Indiana, Kansas, Ohio, Oklahoma, New Jersey, North Carolina, and Tennessee by fully repealing our state’s unfair estate tax.

· Short of full repeal, the estate tax exemption in Washington should be increased to at least $3 million, so it imposes less impact on families and family-owned businesses.

· A $3 million exemption would reduce the tax burden on approximately 46% of those that had been subject to the tax, while still collecting 94% of the revenue generated.

Introduction

Washington is one of just 14 states that currently make death a taxable event by imposing an estate tax.[1] Washington does not impose a tax on estates valued at less than $2.079 million. Yet the state’s estate tax exemption ranks below the national average and our maximum estate tax rate of 20% is the highest in the country. The state’s estate tax suppresses entrepreneurship, impedes economic growth and discourages family businesses from remaining in or relocating to this state.

Studies consistently conclude that estate taxes are among the most harmful to a state’s economic growth. [2] Washington lawmakers should follow the lead of several other states, like Indiana and Ohio, where lawmakers have recently repealed their estate taxes. Short of full repeal, the estate tax exemption in Washington should be increased to at least $3 million, so it imposes less impact on families and family-owned businesses.

Background on Washington’s estate tax

Lawmakers in Washington tax the estate of a dead person if its assessed value exceeds $2.079 million, with the exemption threshold adjusted annually based on inflation. The minimum tax levied is 10% and maxes out at 20%, depending on the size of the estate. Washington’s maximum estate tax rate of 20% is the highest in the country.[3] Family farms are exempt, but there is no exemption for family-owned small businesses, which are hit hardest by the death tax.

Making for an even more uneven playing field for small, family-owned businesses in Washington is the fact that corporations do not pay the tax, and corporate ownership can change indefinitely without incurring the estate tax. Forcing families that own small businesses to pay an extra tax when ownership is passed from one generation to the next puts these families at an unfair disadvantage compared to their corporate competitors. Most importantly, it is unfair because the estate tax targets family-owned businesses that can least afford to pay it, while their larger, corporate counterparts are exempt.

State estate tax was restricted in 1981 but lawmakers re-imposed it in 2005

In 1981, 67% of voters supported Initiative 402, which restricted the state’s estate tax to the federal credit, meaning the state portion could be written off federal taxes resulting in no increased tax burden for Washington families.[4]

In 2005, however, the legislature narrowly passed SB 6096, re-imposing a stand-alone estate tax in Washington. This proposal was adopted after the state supreme court overturned Washington’s estate tax and Congress began to phase out the national estate tax.[5]

The bill was approved by just 50 to 48 in the House and 25 to 21 in the Senate, with an emergency clause, meaning a people’s referendum could not be run against it.[6] A year later, in 2006, voters were asked to once again repeal a stand-alone estate tax in Washington with Initiative 920, but the proposal was rejected.[7]

Since that time, however, Indiana, Kansas, Ohio, Oklahoma, North Carolina, and Tennessee have all repealed their estate taxes.[8] New Jersey is also set to join them, with its estate tax scheduled for full repeal on January 1, 2018.[9]

Lawmakers should increase estate tax exemption

While also working to phase out Washington’s estate tax, lawmakers should increase the exemption to at least $3 million. This would reduce the tax burden on approximately 46% of families that have been subject to the tax while still collecting 94% of the revenue generated.

According to the Department of Revenue, for estate tax collections during 2013-14, if the exemption had been $3 million, 414 out of 909 families (46%) that paid the tax would have been exempt, while still generating 94% of the tax collected ($254 million out of $269 million).[10] This trend holds true for available 2015 estate tax data.

An increased estate tax exemption would further reduce the unfair impact this tax has on small businesses and family estates while somewhat reducing the sting of the family member’s death that triggered the tax.

Conclusion

Death should not be a taxable event. Washington should follow the recent lead of lawmakers in Indiana, Kansas, Ohio, Oklahoma, New Jersey, North Carolina, and Tennessee by fully repealing our state’s unfair estate tax. Short of that, lawmakers should increase the state’s estate tax exemption to at least $3 million, to help reduce the financial burden of death for a substantial number of small businesses and family estates, while still generating approximately 94% of current revenues for the state.

[1] “Does Your State Have an Estate or Inheritance Tax?,” State Estate and Inheritance Tax Rates and Exemptions in 2016, by Jared Walczak, Tax Foundation, May 25, 2016 , at www./taxfoundation.org/blog/does-your-state-have-estate-or-inheritance-tax-0.

[2] “State Death Tax Is a Killer,” by Stephen Moore and Joel Griffith, Heritage Foundation, Backgrounder 3021, July 21, 2015, at www.heritage.org/research/reports/2015/07/state-death-tax-is-a-killer.

[3] “Does Your State Have an Estate or Inheritance Tax?,” State Estate and Inheritance Tax Rates and Exemptions in 2016, by Jared Walczak, Tax Foundation, May 25, 2016 , at www./taxfoundation.org/blog/does-your-state-have-estate-or-inheritance-tax-0.

[4] “November 1981 general election results,” Initiative to the People 402, Elections and Voting, Washington State Secretary of State, accessed November 30, 2016, at www.sos.wa.gov/elections/results_report.aspx?e=32&c=&c2=&t=&t2=5&p=&p2=&y=.

[5] “Final bill report ESB 6096 - 2005,” General Revenue to Fund Education, Synopsis as Enacted, Washington State Legislature, accessed November 30, 2016, https://lawfilesext.leg.wa.gov/biennium/200506/Pdf/Bill%20Reports/Senate/6096.FBR.pdf.

[6] “Engrossed Senate Bill 6096 – Estate tax,” General Revenue to Fund Education, 59th Legislature 2005 Regular Session, Washington State Legislature, May 17, 2005, at https://lawfilesext.leg.wa.gov/biennium/2005-06/Pdf/Bills/Session%20Laws/Senate/6096.SL.pdf?cite=2005%20c%20516%20%C2%A7%203;

[7] “November 2006 general election results,” Initiative to the People 920, Elections and Voting, Washington State Secretary of State, accessed November 30, 2016, at www.sos.wa.gov/elections/results_report.aspx?e=134&c=&c2=&t=&t2=5&p=&p2=&y=.

[8] “State Death Tax Is a Killer,” by Stephen Moore and Joel Griffith, Heritage Foundation, Backgrounder 3021, July 21, 2015, at www.heritage.org/research/reports/2015/07/state-death-tax-is-a-killer.

[9] “New Jersey Estate Tax Changes Effective 01/01/17,” New Jersey Estate Tax Changes, Division of Taxation, State of New Jersey Department of Treasury, October 21, 2016, at https://www.state.nj.us/treasury/taxation/njestatetax.shtml.

[10] E-mail to the author from Kim Davis, Tax Policy Specialist, Washington State Department of Revenue, November 30, 2016, copy available on request.