Do you know how much your gas truly costs?

Consumers have a right to know, understand and verify the taxes that they are paying at the pump.

In Washington state, the real price of gas, apart from state and federal gas taxes, is hidden from consumers. As a result, the advertised dollar price is much higher than the true price of the product.

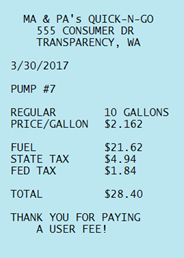

According to AAA, the average cost of regular unleaded gas in Washington, with taxes, is $2.84 per gallon (as of March 31st). The real price of gas, however, is only $2.16 a gallon.

Washington state officials impose a gas tax of 49.4 cents per gallon. Congress imposes an additional tax of 18.4 cents per gallon. In total, Washington state residents pay 67.8 cents in tax for every gallon of gas purchased – a 31 percent increase in the current price. Current labeling reflects the total amount paid ($2.84) after taxes.

As a result, the real price of gas, and the cost of taxes paid, are invisible to the traveling public. This is a contrast to most other costs of car ownership, from purchasing a vehicle to renewing car tabs, which are made very clear to the consumer. In fact, the cost of most retail products reflect taxes separately from the real price of the product.

For example, consumers can fill their gas tanks based on the advertised price, and then buy a quart of oil and an air freshener at the same station. The advertised prices of the oil and the air freshener show the true retail price, with the tax added later. However, for the major purchase – gasoline – government officials have hidden the tax in the advertised price of the product.

Visibility of gas taxes is especially important when it comes to transportation spending. Washington now has the second highest gas tax in the nation after Pennsylvania, yet some lawmakers want to impose additional taxes. They say the increased gas tax, coupled with increased vehicle miles driven, is still inefficient.

The public should not have to take public officials at their word. Instead, they should be able to review, verify and engage with public officials regarding their claims.

To solve this problem, Representative Cary Condotta has proposed House Bill 2180 to provide fuel tax transparency. His proposal would require the Washington State Department of Agriculture (WSDA) to “produce a sticker for display on each motor fuel pump…that provides the federal and state motor fuel tax rates.” The stickers would be displayed “on each side of the fuel pump where the price of fuel is displayed” in a “clear, conspicuous and prominent manner.”

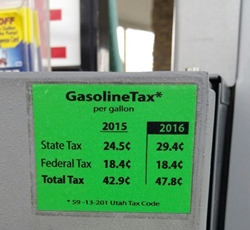

This system works well in other states. Utah officials, for example, post federal and state gas taxes on a sticker at the pump, as pictured below:

To encourage open and transparent dialogue about how transportation is funded in our state and whether or not the gas tax is efficient, lawmakers must provide more – not less – information to the public on existing revenue streams. Enacting a truth-in-labeling law for gas stations would inform consumers of exactly how much they are paying for gas and how much they are paying in taxes for transportation infrastructure.

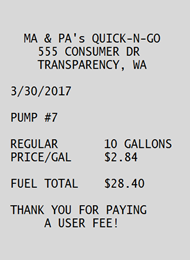

Washington Policy Center recommends that lawmakers extend this policy to customer receipts as well, which should show a similar breakdown of gas price, state tax, and federal tax, as exemplified below.

Current fuel receipt: Transparent fuel receipt:

This greater level of transparency would increase public trust and empower taxpayers to better understand the complete costs of transportation infrastructure, whether it is paid for with current gas tax dollars or with other proposed sources of revenue.